Grow your Business Quickly using proven large company Strategies

Categories: Business Growth

Many quality private businesses are currently finding growth of their top and bottom line extremely difficult. There is no doubt that most business owners spend hours developing new ideas to increase sales and decrease costs to assist the performance of the business. These activities should always be undertaken, however, they rarely get strong support from staff and hence seldom get the sustained outcomes that the business owner requires or believed was possible.

As an exercise, make a short list of some of the internal ideas / tactics for improving the sales and profit that you have implemented over the past 12 months. Then rate them as to the overall effectiveness against your initial expectations and also against the overall benefit to the business.

In most cases these well-meaning and necessary ideas / tactics either underperform significantly compared to the original expectations, or the results, if positive, do not make a significant enough impact on the businesses profit or cashflow to satisfy the stakeholders.

This is not to say that you should abandon this approach, all businesses should continue to develop and implement short and medium term tactics and plans to improve the business; you just cannot afford to rely on these tactics alone. One of the best ways to improve the results in your business is to have a clear and powerful vision for your business. This will assist greatly in inspiring and involving your key staff to drive the necessary plans. Also, a clear vision leads to the development and clarity of a positive big picture strategy for your business, unlike the series of short term tactics that seem to bounce around the organisation and either fail or just underperform. (See further reading article below by Collins and Porras in Harvard Business Review)

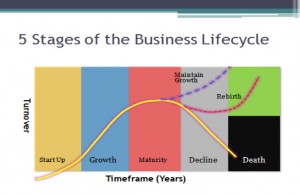

In my opinion (any many other experts) for companies that are nearing the end of their growth phase or are in the maturing phase (see below) they need to consider as part of a 5 year Vision for the business, to have a Strategic Acquisition plan to add significant growth to the top and bottom line of the business. An acquisition strategy at this stage greatly assists the maintenance of the business growth cycle. Acquisition strategies should not to be undertaken at the total expense of organic growth plans; this skill is still critical and will be beneficial when adding new products, services or clients to your business.

Strategic Acquisitions are one of the main strategies that large companies have used for decades and continue to use to ensure they have continuous growth. You would have heard many times about the mergers and acquisitions (M&A’s) that occur at the big end of town and the large accounting and specialised M&A firms that assist them with their strategy, negotiation and execution of these acquisitions and mergers.

Take for example Warren Buffett and Bill Gates; two of the most successful entrepreneurs of the modern day. Both of them in different ways continue to grow their wealth by an aggressive acquisition program combined with organic growth strategies within their companies. Microsoft alone has purchased outright over 146 companies and acquired majority stake in over 60 other companies. (See further reading below for link to Microsoft acquisitions).

An Acquisition strategy also can work extremely well for private companies. However, I understand that this is not an area of growth that most private business owners have traditional thought of as being within their reach or understanding.

Some of the benefits of growth via acquisition:

- Can create greater economies of scale quickly by absorbing other businesses

- Can improve profits, cash flow and business value considerably

- Adds stimulus and interest to your business

- If part of the longer term strategy, acquisitions can help diversify the business into higher growth sectors

- Creates stronger customer network to sell associated products

- Can take out a competitor before someone else buys them

- Growing businesses attract top quality executives ( which can assist with running the business and an eventual sale or exit)

There are numerous other benefits of acquisitions and any potential acquisition should only be done as a considered part of an overall Vision and strategy for the business.

With any business direction or decision comes risk; growth via acquisition also has its risks as there are no 100% guarantees in business. However, I recommend if a business is looking at making an acquisition, then start with a target that is no more than 1/3 to 1/2 the size of your existing business. This will always depend on balancing the specific issues of the deal such as pending complexities of integration and or financial risk compared to the potential short and longer term benefits.

It has been well documented that there is a large number of business owners of the baby boomer generation that are looking to exit their businesses. Hence, supply is good for acquisitions; however the challenge is to find an appropriate business with the right synergies to increase the likelihood of post-acquisition success.

When it comes to financing these acquisitions; generally it is perceived that funding is tight, however, I know from experience that banks are more than willing to assist their quality clients with funding on acquisitions that the bank knows has been well researched and considered as part of the 3-5 year Strategic plan.

Here are a few thought provoking quotes to be inspired by;

“If you do what you’ve always done, you’ll get what you’ve always gotten.” -Tony Robbins

“Your life does not get better by chance, it gets better by change.” –Jim Rohn

“It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.” – Charles Darwin

If your plan is to sell in the next few years then consider the following:

Firstly, be careful and do not allow your business to slowly drift towards retirement, as it can easily fall into the later phase of the business life cycle being decline / decay and prospective buyers will not find it attractive.

A structured and active growth strategy for the business is critical, as the best time to sell a business is when it is still growing and is supported by several years of growth.

Hence an Acquisition strategy (combined with organic growth plans) is ideal if the business owner is contemplating selling or retiring in the foreseeable future as it creates size and can significantly increase business value.

The strategy is to have growth via a series of modest, safe and high returning acquisitions; there are a lot of businesses opportunities with turnover between $1 to $10+million which will enable you to grow quickly and profitably. My view is that businesses need to grow to a size that makes them attractive for small public companies or Private equity firms to acquire them in the future. These companies do pay higher multiples and have a strong appetite for growth via acquisition, but they will avoid buying “small” companies as they see them as a risk and not worth their effort.

Make sure you are ready for a sale. By following this acquisition strategy your price could increase greater than fivefold in just a few years. Plus an additional benefit is the growth strategy generates a large amount of energy and interest in your business, which makes it an exciting environment.

If you are now interested or motivated to understand more about accelerating your business growth via acquisition, then consider the fact that the large public and private equity firms consistently utilise specialists to assist them. It would be wise to be guided via an experienced and qualified professional in this area.

Hope this assists your planning for growth.

Further reading

Build your Company’s Vision” ; by James C.Collins and Jerry I. Porras

Harvard Business Review Article, September 1996

http://hbr.org/1996/09/building-your-companys-vision/ar/1

Warren Buffett’s Best Buys ; find it at –

http://www.investopedia.com/articles/stocks/08/buffett-best-buys.asp#axzz28lQjaS00

List of mergers and acquisitions by Microsoft ; find it at –

http://en.wikipedia.org/wiki/List_of_mergers_and_acquisitions_by_Microsoft

Smart Acquisitions

By Tom McKaskill : Lecturer at Australian Graduate School of Entrepreneurship, Swinburne University of Technology, Melbourne, Australia.

http://www.ceoonline.com/expert_talk/succession_merger_acquire/buy_business/pages/id20007.aspx