Kick start your business and return to growth – quickly and safely.

Categories: Business Growth

So your business growth has slowed or stalled, how do you return to consistent strong growth?

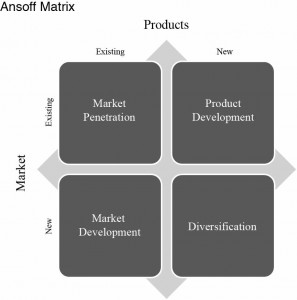

From my experience there are two types of proactive business owners when it comes to the issue of growing or turning around a business. The first type are those owners who believe strongly in traditional organic methods of growth, as outlined in the Ansoff Matrix, which in summary is as follows;

- Market Penetration; sell more of your existing product or service to your existing customers and in your existing markets,

- Product Development; develop new products to take to your existing customers and market, or

- Market Development; take your existing products to new customers and markets.

The traditional model argues that there is also another, slightly riskier path to take:

4. Diversification; develop new products and attempt to find new markets for them.

The latter is generally used if the existing industry sector that the company operates in is in serious decline and or the existing products are at the end of their life.

I find that many private businesses will use strategies one to three, and I would be pleased to say that very few would attempt the fourth strategy of diversification, as this has the highest risk. However, while strategies one to three above are common practice, these approaches require intense new product and or market development, innovative new marketing approaches, potentially lots of investment dollars, and time. They also require a lot of effort, skill and focus from the existing management and key staff to effectively implement these strategies.

While these are sound strategies, many times they become just another tacking manoeuvre which yields lower than expected outcomes.

Most business owners who follow the traditional organic (slow) path may be uncomfortable with a non-traditional (non-organic) approach to growth. If you are a member of this group of business owners, the first part of my book (Crank It UP) is designed to enlighten you to the alternate opportunity of business growth via acquisition (i.e. buying a motor for your yacht). This utilises strategies one to three from the above model, but takes them to a new level.

The second group are business owners who have either heard of or seen a friend grow their business via an acquisition or two and generally believe that growth via acquisition is a viable option. Often though, these owners are unsure as to the process and methods of achieving strong results from this strategy. In many cases whilst these business owners may have some previous awareness of the strategy they may not be fully aware of the best ways to gain strong profit and wealth outcomes in a short time frame and they may not have the necessary skills or experience required to reduce the potential risks.

For both groups of business owners, my book will help provide the knowledge of how to develop the required skills, as well as the confidence to proceed with a strategy of growth through acquisition, which is utilising traditional growth strategies but at an accelerated rate.

Investing for Organic Growth

Most businesses have started from humble beginnings with the owner putting his or her time, effort and personal capital (savings and many times borrowings against their primary home) into growing the business from scratch. At this stage the concept of reinvesting in the business is fundamentally core to most business owners, particularly when they start to generate profits and then reinvesting those profits in the business.

The typical strategy here is to take advantage of the growth phase by hiring more staff to grow sales, or managers to manage and develop the processes. Other characteristics include investing in plant, equipment and other fixed assets such as machinery, computers, software, motor vehicles, as well as intellectual property through research and other forms of reinvestment. All of this reinvestment in the core business is focused on allowing the business to grow to the next stage. The alternative would see a business owner taking funds from the business as drawings.

Generally when a business owner makes the decision to reinvest his or her profits into the business, they will conduct an evaluation (either formal or informal) prior to that reinvestment as to what that new asset is going to achieve in assisting the business in its growth phase. Naturally there will be an expectation that the reinvestment is going to generate a return on investment in the foreseeable future. You would therefore expect that as the business grows the organisation would ensure that they have installed a more formal analysis of the pending return on each piece of equipment or every dollar of reinvestment before they actually committed to the investment in equipment or assets.

However, many private companies invest in the next piece of equipment (or the next salesperson or the new software), based largely on a gut feeling that it is the right thing to do to move the business forward. As a consequence, this kind of investment is largely undertaken without a great deal of formal analysis of the time frame required in order to achieve an appropriate return on investment or a clear understanding on what the return on investment will be. Many times it is the business owner that makes the decision on the key investments, only superficially involving the experience and advice of senior staff and management. While the business owner may have discussed or involved the senior staff/management in the process, the staff are generally not held accountable for the results of the investment and hence, do not have the same level of commitment to the success of the new investment as the owner.

It is not uncommon for an organisation that is well into its growth phase, yet experiencing a slow-down in sales growth and a decline in profits, to attempt a reinvigoration of their business by reinvesting in new equipment or systems. This is when the business owner starts to feel those previous strong winds lose their strength. He or she can sense a slow-down is coming, and starts to consider investing in new sails or equipment, tacking in one direction then another in an attempt to hopefully catch the changing winds.

This usually involves an effort to make the business more efficient by bringing down the unit cost or keeping capital equipment up to date. It is at this point, when growth has slowed down significantly, that these businesses must consider the potential benefits of reinvesting in new equipment and/or additional key staff in the business. How much of a return is really possible?

Far too often, I have seen businesses that are well beyond the growth phase (and in fact probably in the later stages of maturity or in decline) when the owner(s) decides that the way to turn the business around is to reinvest in more modern equipment, which is designed to make a different or more cost-effective product, on the basis that this formula has worked for the business in the past. However, this ignores the stage in the business lifecycle, and the effects of the product or business cycle. Many times when a business’s growth has slowed right down and is potentially in decline it is imperative that a capital reinvestment strategy (whether it be for more equipment or faster equipment or similar products or new IT systems) is carefully discussed and analysed, because often, when critically reviewed, the answer could be that it would be best to invest another way. As a minimum, an investment plan should be formally developed and critically reviewed with buy-in by senior staff who will be given the responsibility to implement.

A clear assessment of business risk and return is required at this time.

Many times the certainty of what an acquisition strategy can bring to an organisation in relation to return on investment and future growth is much greater than what the return would be if the equivalent investment was in capital equipment or other types of assets in the business. I have also found that by involving senior management in the process, the capable ones who can take your business forward, stand up and support the investment and work with you, while those who do not openly support the direction are generally already holding you back and will continue to do so.

Businesses need to have a strong focus on running their company efficiently and effectively. I’m not advocating that growth via acquisition is the only answer to growing a successful business. Businesses also need to continue to focus on improving their systems, marketing, employee development, LEAN (business efficiency programs) tools and the like, along with all the other aspects of the business that they have been working on throughout the journey. However, growth by acquisition gives an additional boost that these tacking manoeuvres cannot. An acquisition can be a motor for your business, whereas everything else is trying to chase the elusive, fading wind.

Businesses need to understand their numbers and ensure they have good reporting procedures and quality staff who are accountable for results. They also should take on development programs for their key managers as it is important before a company undertakes an acquisition strategy that the key management group is well developed and skilled. As the business owner can only stretch him or herself so far, it is critical that the business has a team of strong, reliable people with systems, procedures and accountability measures to enable the company to have confidence moving forward into an acquisition strategy or any form of new investment.

Not reinvesting in one’s business for a prolonged period is a sure-fire way to accelerate the business demise; so the only real strategy is to continually reinvest in your business to gain the best results. This reinvestment includes strategically reviewing your industry and product lifecycle to ensure you are not on a dead end path, before you invest further into it.

Investing via Acquisition

An alternate way to invest in and grow your business or to turn it around is through an investment in the acquisition of other businesses by applying the Ansoff principles that we have covered off above. My view is that too often the focus is on utilising the above strategies in an organic manner to gain growth; I strongly believe in and have had success in taking these same well-structured strategies and accelerating them via utilising the acquisition approach.

Be aware that often once business owners learn about acquisitions as an opportunity to grow their business, some incorrectly believe it to be a quick fix. However they can neglect the problems in their existing business and try to turn the business’s fortunes around or improve the results solely through acquisition. If the foundations of the core business are not strong, the combined and enlarged new business could suddenly become a bigger problem and more difficult to control rather than providing a solution. Therefore, for organisations that have not undertaken acquisitions in the past or have attempted it without yielding the expected benefit it is generally a wise decision to involve an experienced adviser in the early conceptual stages to assist in reviewing the core business and the strategy before moving forward.

We all see a large number of publicly listed companies posting profit growth year on year. The main reason for pursuing this growth strategy is that they have a shareholder base that is ruthless for growth in their dividends and share price. Most of us now have money tied up in superannuation funds, which invest in, among other things, publicly listed companies; and we all expect our superannuation portfolio to earn a good return each year and grow in value. Hence the pressure is on the CEOs and Boards of these public companies to grow the profit and value of the business each year. In short – slowing in the maturity phase or falling into decline is not an option. They must keep growing, whether the wind is in their sails or not.

So how do they do it? Largely they achieve this by thinking and acting outside the traditional way of growing a business organically. They use strategic acquisitions.

While it is no secret that growth via acquisition is regularly undertaken by large companies, that doesn’t mean that this strategy is the exclusive domain of large companies. One of the key benefits of businesses of all sizes, small, medium and large is to use such acquisitions to grow their business at a predictable, steady and controllable pace with a much better idea of what impact it can have on their business post-acquisition. Once the business is clear about its strategic objectives, the strategy should be to concentrate on the wide range of available organic growth tactics (e.g. marketing), with a view to trying to maintain some base organic growth rather than decline, even if that growth only amounts to some 2% to 5%. Alongside these tactics I recommend the company should include the strategic approach to acquisition with the intention of adding 15% to 25% (either annually or bi-annually).

There are various strategic approaches to growth via acquisition and the most effective one will depend on the numerous factors facing the business, some of which will be outlined later in this book.

About the Author: Warren Otter

Warren Otter is both an investor and a specialist advisor to medium-size business owners. He is the author of ‘Crank It UP: The proven way to drive your business to greater wealth’ and has been a business owner in the manufacturing environment for over 20 years.

He grew his first business from $4.5m to $25.0m revenue back in 2005. In that year he won the Monash Business of the Year award, beating many larger and more well-known businesses.

At that stage Warren had just completed his third bolt on business acquisition and both the award and growth was largely due to the A grade management team he developed.

Also, have a look at the other articles on this site. Best of luck in running and growing your business.